A Wise business bank account is the best option for businesses working internationally. From small to large enterprises, Wise remains a top choice for users due to its cost-effective features.

Integrated with features, namely multiple currencies, low cost, zero monthly fee, etc. Wise empowers small and medium-sized businesses to take control of their finances without the usual banking friction

Whether you are a freelancer, a startup, or a growing business, switching to the Wise platform is a smart move.

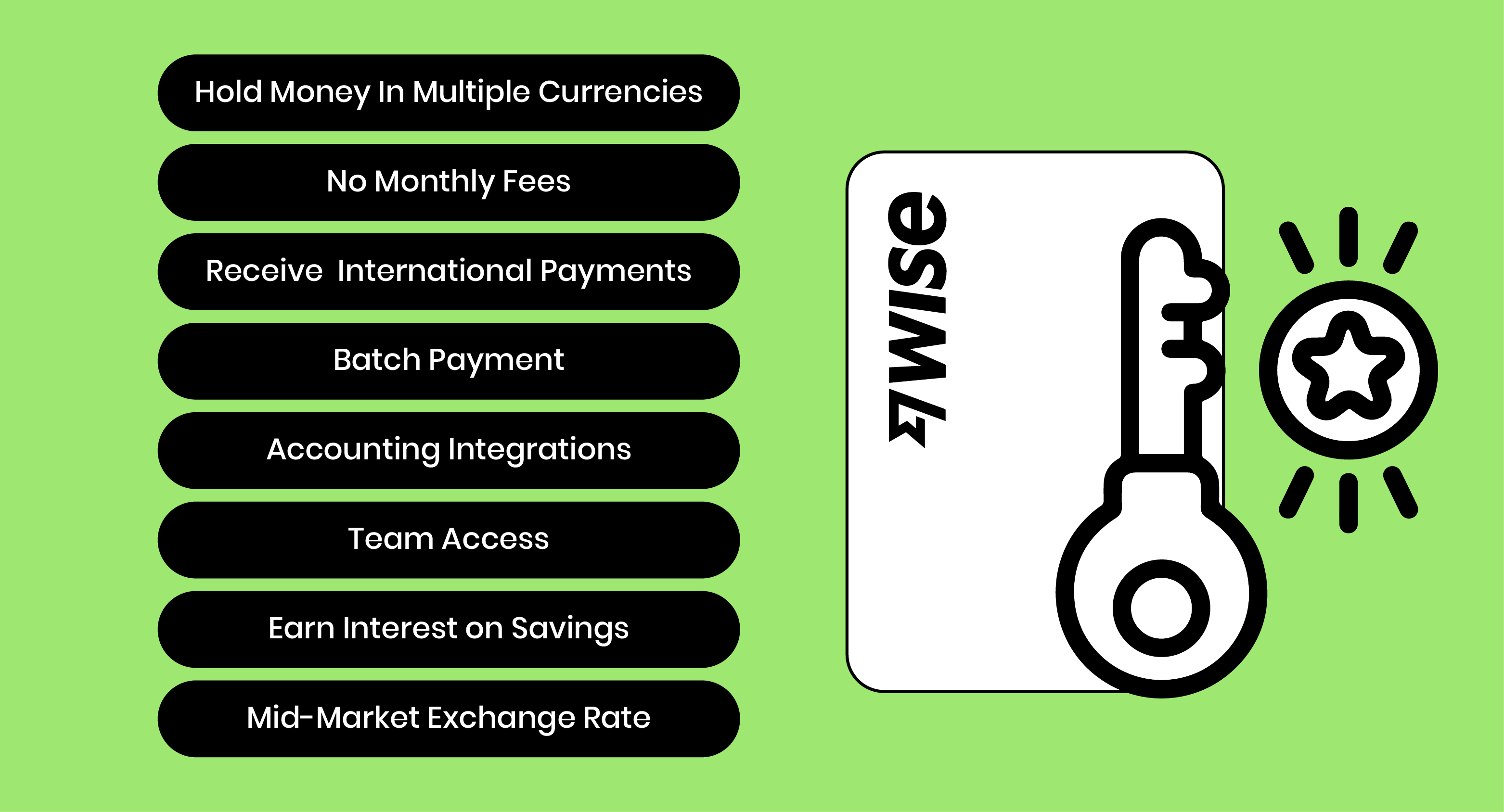

Key Features of Wise Business Bank Account for UK Users

Some of the standout features of the Wise business account for UK users are explained as follows:

Hold Money in Multiple Currencies

Wise business bank accounts facilitate users to exchange and hold over 40 currencies in one account. It alleviates the worries of opening multiple bank accounts for different currencies.

Businesses working internationally can easily receive, send, and convert money between currencies with just one account. The benefits of Wise for international money transfer persuade firms across the world to choose Wise for their international transactions.

No Monthly Fees

A Wise UK business account does not demand monthly maintenance charges. You only pay per transaction, which is beneficial for small businesses looking to avoid hefty bank costs.

Besides being free of cost, a monthly subscription, Wise business accounts ensure complete transparency. Wise business and personal accounts' commitment to strong data security has helped Wise to earn respect as a trustworthy global international transfer platform.

Receive International Payments

A Wise business bank account provides local bank details (like a UK sort code, US routing number, EU IBAN, etc.) for your business so clients abroad can pay you as if they are a local. This reduces the fees and delays associated with traditional bank international transfers and helps users get paid faster and cheaper.

Batch Payment

The Wise account for business has batch payment features that enable businesses to pay more than 1000 people at once. This feature is beneficial for companies that process mass payroll, pay freelancers, and send money to multiple vendors.

Accounting Integrations

Wise business account integrates with cloud accounting solutions like Xero and QuickBooks, ensuring transactions are automatically synced. It uses the Wise API that streamlines workflow and saves time by reducing the need for multiple data entries.

Team Access

Wise business bank accounts allow you to add team members and control their access levels. This feature is beneficial for delegating tasks such as managing payroll. Having oversight of your finances, you can grant either view-only or full access to suit your team’s roles

Earn Interest on Savings

The Wise business account’s interest features enable businesses to earn returns on the money in their accounts. Wise automatically changes your funds into low-risk, government-backed assets through its investment partners rather than letting unused funds remain idle.

Mid-Market Exchange Rate

Wise account for businesses allows sending money to over 150 countries with low, transparent fees. Unlike traditional banks, it uses the mid-market exchange rate to avoid inflated conversion costs. This ensures your international transfers are both cost-effective and reliable.

Types of Wise Business Account

To open a Wise business account, you first have to decide which type of account you need to open:

Startup Business Bank Account: This bank account is ideal for small businesses, freelancers, and sole traders.

Business Bank Account: It is a wise choice for established companies

Community and Not-for-Profit Account: charity, social enterprises, clubs, and schools can opt for this account as it offers no or low-fee banking.

How to Open a Wise Business Account Online

To open a Wise business account, follow these simple steps:

- Sign in to your account.

- Go to settings and click on 'Open a business account'.

- Share or fill up the required details such as your business location, industry, category, etc.

- Pay the one-time fee of £45.

- You will receive a confirmation email once verification has been processed.

Wise Business Account Requirements

Wise business account requirements are following:

- Contact details of the account representative

- Provide details of all partners, directors, and members of the business

- Complete details of the business, such as registered and trading address, if different.

Upload the following documents:

- Photo ID and proof of address for the account representative

- Business documents, depending on the entity type

Depending on the business details and type, you can expect to be asked to fill in additional information:

- Business category

- Account purpose

- Business website

By fulfilling these requirements, you can easily open your Wise business account.

FAQs

How can I open a Wise Business Account?

To open a Wise business account, simply visit the Wise website, click “Register,” and choose the business option. You’ll need to provide your business details and verification documents. The setup is entirely online and typically completed within a few working days. Additionally, Wise business account opening fees are lower than other banks.

What is Included in a Wise Business Bank Account?

A Wise business bank account lets you hold and convert money in multiple currencies, receive international payments, pay invoices, and connect with accounting tools. It also offers batch payments, team access, and no monthly maintenance fees, making it a modern alternative to traditional business banking. Additionally, using Wise business cards allows businesses to manage multi-currency payments and expenses globally with ease.

Does Wise Offer a Business Savings Account?

Yes, the Wise business savings account, also known as the Wise Interest feature, allows you to earn interest on unused business funds. Your money is held securely and can be accessed anytime, letting you grow your funds while maintaining liquidity.

Wise business accounts offer cost-effective transaction solutions. With no monthly fees, real exchange rates, and tools designed to simplify financial operations, it’s a strong alternative to traditional business accounts.

Its adherence to robust security measures ensures credit card encryption, making it ideal for small to medium-sized businesses. Equally important is utilizing the best anti-phishing tools and services with the aim of countering various types of phishing attacks.

using a strong password manager Chrome extension helps prevent credit card data breaches by auto-filling credentials, reducing phishing attacks.

Undoubtedly, opening a Wise business account is a smart option for those looking for a banking solution that grows with your business and saves you time and money.

Stay tuned to Virtual Codes Vault for more information!